Launching: Boring SaaS

How boring SaaS businesses present an excellent opportunity for wealth creation

Boring SaaS enables people to leverage ‘boring’ small SaaS businesses for wealth creation. We explore playbooks and share best practices on how to acquire, operate, improve, and sell boring SaaS businesses.

Hello SaaS enthusiasts,

Thanks a lot for joining this journey.

Today marks a milestone - the first episode of the Boring SaaS newsletter. And you are part of our initial launch group. Thank you!

What we’ll cover today:

Conventional routes to SaaS ownership

What is boring SaaS?

4 success stories of boring SaaS business

How can you get involved?

Before we get into the weeds - let’s talk about what motivates many of us: financial independence. Unlocking this freedom often involves owning small businesses, but the path to ownership can seem elusive. We want to leverage our expertise to help businesses grow, and the prospect of owning a significant stake in a company is very motivating.

Many of us in the SaaS industry possess relevant experience, having worked in sales, presales, customer success, marketing, or other departments.

So, why do so few of us actually own a SaaS business?

Conventional Routes to SaaS Ownership

Let's look at the most common paths to business ownership:

Found your own company: while launching your own venture is an option, the high failure rate of startups (9 out of 10) makes it a risky and often unviable choice.

Buy shares of publicly traded companies: owning shares in the public stock market is the quickest route to ownership. However, it provides limited impact on the success of the investment and offers minimal involvement.

Investing in a startup: investing in other founders' ventures shares the same risks as starting your own business. Early-stage investments are often based on ideas or founding teams, with later stages leading to escalating valuations and potential dilution.

So, where are the businesses with proven track records, generating profits, and small enough for you to acquire a meaningful portion, if not the entire business?

Boring SaaS Businesses

Turns out - they exist! There are even lots of them. These are the ‘boring SaaS’ businesses—small, profitable companies that have conquered and dominate specific niches.

These businesses often fly under the radar of public media, which tends to focus on unicorns and high VC funding raises. This oversight creates excellent opportunities for those who want to get actively involved.

Let's have a look at some success stories.

Success stories

1 - Turning $1k investment into $92k in 5.5 years:

Entrepreneur Priyadarshan Joshi (“PD”) purchased Split Screen for $1,000 in an online auction. The app lets users change the size of their window panes to look at two windows simultaneously. When PD purchased the app, it was available for 99 cents in the MacOS store and generated $200 monthly revenue.

PD implemented a number of changes: changed the logo, tested different price points, found $6.99 as the sweet spot, and added a premium version for $19.99.

After 5.5 years, PD had made over $92,000 from the app.

2 - Netflix engineer flips a SaaS business with 100% profits in a year:

In 2021, Michael Lin, a former engineer at Netflix., made a pivotal career move by leaving Netflix to acquire RecordJoy, a one-click screen recording tool in its pre-revenue stage. Lin, along with a co-founder, strategically assessed the tool's potential across various use cases, envisioning applications in customer support, gaming, teaching, and more.

With a revised growth plan, they acquired customers from AppSumo, ultimately generating $1,000 in monthly recurring revenue. Despite the business's success, Lin and his co-founder decided to sell it after a year due to personal reasons. Remarkably, they sold the business for twice the initial purchase price, securing a 100% profit.

3 - Buying 5 figure SaaS company and tripling its MRR in 3 months:

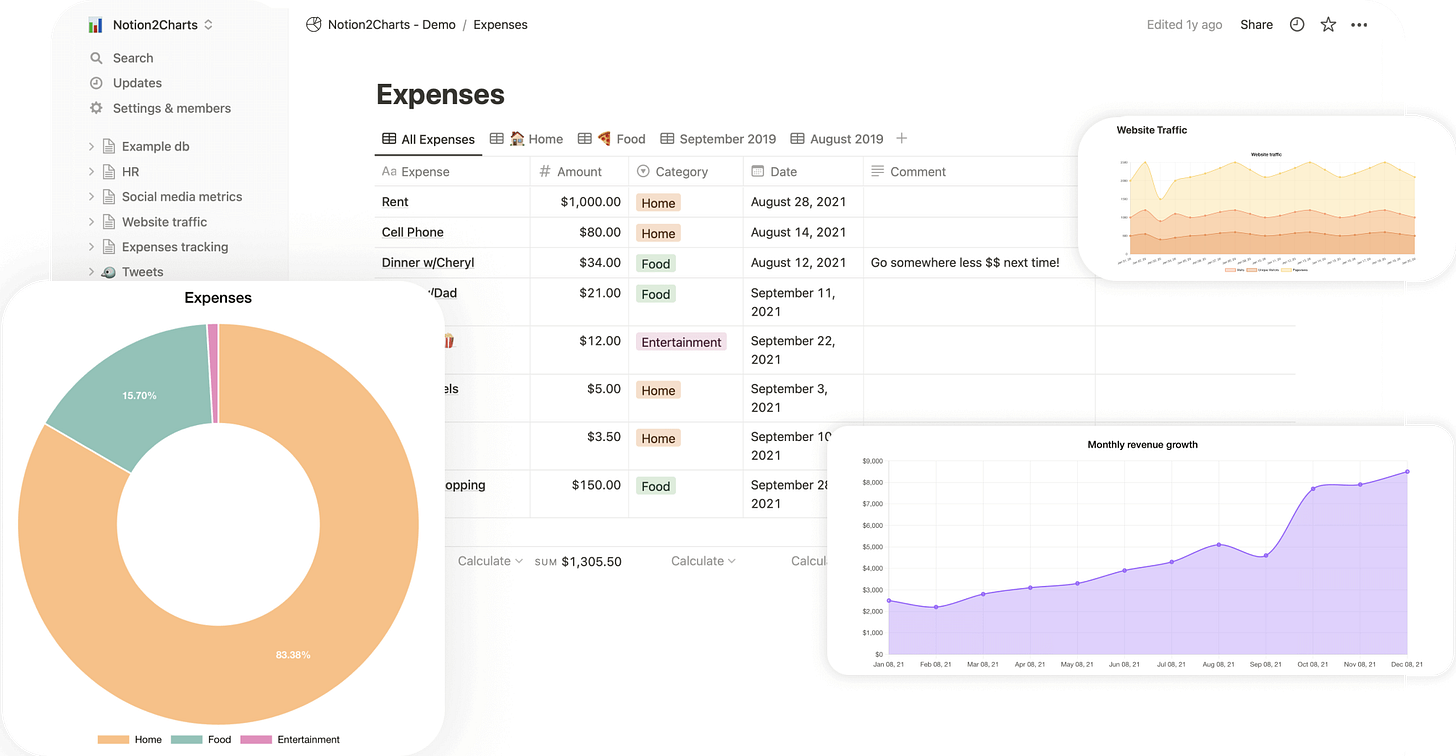

Scott Fitsimones bought Notion Charts for a five figure amount in March 2023.

He implemented new growth strategies which included product upgrades, such as an official Notion integration, customer retention initiatives, email automations, and an intensified social media marketing campaign.

As a result, he tripled the monthly revenue within a remarkably short span of three months post-acquisition.

4 - Increasing SaaS venture valuation by 76% in a single quarter:

Our final example introduces Phil Crumm, who took a unique approach to SaaS business ownership. Crumm initiated his journey by purchasing a startup at a 2.1x revenue multiple. Rather than focusing solely on operational improvements, he strategically concentrated on factors that would elevate the company's valuation.

Implementing standard operating procedures to facilitate a seamless handover, refining customer onboarding processes to enhance retention, and shifting the marketing strategy from features to customer problems were among Crumm's key initiatives. The results were remarkable, as Crumm successfully sold the company with a 3.7x multiple in just one quarter, marking a 76% increase in valuation.

So, what do all of this mean for you?

How can you get involved?

These examples showcase multiple ways to take ownership of a ‘boring’ SaaS business, implement operational improvements, and benefit from increased returns—whether by selling the business or capitalising on enhanced profits.

Professionals from various backgrounds can contribute significantly by leveraging their specific expertise. Whether you possess expertise in product development, sales, customer success, marketing, or any other relevant field, your success comes down to the value you can add and your ability to take responsibility for an entire business.

It's crucial to note that this is not a quick path to wealth; it requires substantial effort and expertise. It may not be suitable for everyone.

In future episodes, we will discuss various playbooks on how to acquire, operationally improve, and potentially sell ‘boring’ SaaS businesses.

We will analyse success stories, best practices, and potential pitfalls. As part of this, the content will cover two big areas: transactions and operations.

Transactions » buying and selling boring SaaS

Where to find buying opportunities

How to evaluate a boring SaaS

How to do due diligence

How to transfer a company

How to sell

Operations » increasing the value of your company

Where to find leads

How to optimise a sales funnel

How to use new product features for revenue growth

How to decrease customer attrition

How to increase SaaS valuations

… and of course much more.

It is the goal of Boring SaaS to empower individuals to achieve financial independence by teaching new strategies for leveraging ‘boring’ SaaS businesses for wealth creation.

I cannot wait to get started with you.

All the best,

Nicolas

PS: are you a boring SaaS owner and have a story to share? You can simply respond to this email. I am always looking for stories to feature in the newsletter.

You have a friend who would be interested in this content? Please click below to share.

I share more frequently on X (Twitter). Feel free to connect with me.

The content is for informational purposes only, you should not construe any such information as investment or financial advice.